Top Ten – Insurance Mistakes for Food Trailers and Food Trucks

Top Ten – Insurance Mistakes for Food Trailers and Food Trucks

Insuring your food truck or trailer can be a messy business. Legalese, weird gimmicks, and confusing rules are all over the place – and it can be difficult to make sure you’re actually getting the coverage you need.

Let’s run through the most common mistakes mobile food business owners make when they purchase insurance – as well as tips on how to avoid them.

1. Buying The Lowest Price Policy You Can Find

Choosing low-cost insurance can – ironically – end up costing you a lot of money.

Many low-cost policies have a remarkably small list of claims they cover. You may find yourself with a surprise bill if something happens and the insurance only covers the event partially – or not at all.

Like with most things in life, you get what you pay for when it comes to insurance. And since insurance companies are continually pressured to lower prices, they’re also forced to reduce plan benefits. This hurts the relationship between the insured and the insurer, especially when claims are filed that aren’t covered by the plan.

We advise you to be thorough when it comes to evaluating your specific needs. Don’t just jump at the lowest price – jump at the plan and agency that fits you best.

2. Paying Extra For Additional Insurance Certificates

Commissary kitchens, landlords, event managers, and city health departments often require that you present them with additional insurance certificates. Frustratingly, many insurance agencies charge you between $10 and $50 for these certificates – which are just sheets of paper.

We don’t charge you extra to process additional certificates. And since our average client needs 20 of these additional certificates per year, we save them up to $1,000 annually.

There’s no reason an insurance agency should surprise you with an additional charge for something as simple as an additional certificate.

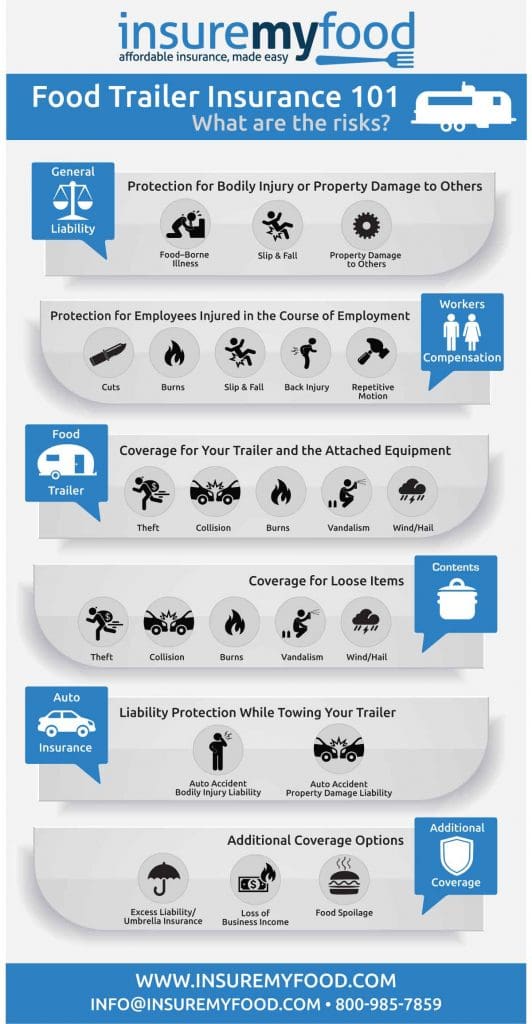

3. Incorrectly Classifying Your Truck And Property Values

The insurance world considers your food truck or trailer and your other property as two distinct things with two distinct coverages. This means that property coverage doesn’t include your truck/trailer unless specifically stated on your policy.

Many food truck owners assume wrongly that property coverage is enough. And you can imagine how unpleasant of a surprise that is when they try to submit a claim for their truck.

Here’s what the value of your truck/trailer entails:

- The value of the truck or trailer on its own

- The value of “permanently attached equipment” (attached via plumbing or gas)

Everything else is considered “business property” and needs to be listed separately on the insurance policy. For a better look at how this works, check out our blog: How much is my food truck worth?

Tip: Make sure to update your policy when you install new equipment and raise the value of your truck. If you forget, the new items will likely not be covered.

4. Covering Your Trailer On Your Personal Auto Insurance

You’d be surprised at how many people believe that their personal auto policy automatically extends coverage to their food truck or trailer. Your business truck/trailer will not be covered by your personal auto insurance.

The confusion comes from the fact that many auto liability policies will still cover the accident for the other vehicle if you’re pulling a trailer (though you should confirm with your policy).

For example, if you get in an accident while pulling a trailer, your personal auto liability insurance would cover the damage to the other party’s vehicle. However, the physical damage to your own trailer would not be covered.

5. Accepting A Deductible On Your General Liability Policy

Some agencies sell general liability policies that include a deductible that you are responsible to pay before the insurance company starts to pay up on a claim. While this may feel normal since it’s the case with health insurance, it’s quite problematic when it comes to food truck insurance – and you shouldn’t have to put up with it.

Auto claims are rarely cut and dry when it comes to your liability and how much you owe, which means deductibles add a whole new layer of stress and complexity that’s completely unnecessary.

With no deductible, you can file the claim then let the insurance work out the legal fees and handle the claim. This way is much simpler, streamlined, and eliminates a handful of extra costs.

6. Purchasing Insurance Valid Only At A Certain Address

Once again, you’d think that mobile businesses wouldn’t limit their insurance coverage to a single address, but it does happen from time to time. You don’t just want your truck/trailer covered in a couple parking lots – you want it covered everywhere.

Granted, this mistake is often completely accidental since insurance policies originally were designed to cover businesses operating from a single location and, thus, typically only cover a single address by default.

But you’re not working from a single location. Your business moves around – and you need a policy that moves around with you. For this reason, be mindful that your insurance agency isn’t giving you standard policy that isn’t a good fit for your mobile business.

7. Select An Agency That Does Not Process Certificates Same-Day

Need a last-minute certificate of insurance? Many companies refuse to process these on the same day, which can be a major problem for food truck owners who show up to events that require a certificate but didn’t tell vendors in advance. The nature of this industry is quick and ever changing, and you need an insurance company that will keep up with your needs in a pinch.

8. Buying From An Agency That Doesn’t Specialize In Mobile Food Businesses

As you can see by now, there are quite a few quirks to covering your food truck that your average insurance agent won’t have any idea about. Don’t leave your business in the hands of someone who doesn’t know the in’s and out’s of mobile food insurance specifically.

Here are a few reasons you should strongly consider working with a food truck/food trailer specific insurer:

- They’ll understand your business. A traditional agent may not “get” the mobile business idea, but a mobile food specialist definitely will – and that’ll mean more appropriate coverage, advice, and claims assistance.

- You’ll have a trusted partner. No more worrying about how you’ll explain your situation to the agent who only works with brick-and-mortar locations. Your agent will be your partner who knows the insurance and business struggles of owners like yourself.

- Your policy will be better than ever. An agent that knows the mobile food truck business will know the mobile food truck insurance world – which means your policy will be much more fitting than one selected by a non-specialist.

- Policy adjustments and claims will be easy. New quotes, equipment changes, and service requests will be quicker and easier than if you’re working with someone who always has to “check the rules” for every little thing.

Get the coverage you need from the informed, savvy partner you need.

9. Not Reviewing Insurance Requirements For Specific Events

Insurance requirements can vary widely, which can lead to some headache as a mobile food business. Different states have different food service laws – and even certain cities within a single state can throw you a curveball.

Do yourself a favor and check up on each event’s requirements. Or better yet, send the requirements to your insurance agent to help you review them and advise you on whether or not you need a policy adjustment.

10. Wasting Time With Agents That Don’t Get Your Business

There’s nothing as costly and frustrating as an insurance agent who claims to be your partner but has no idea how your business is structured, what your struggles are, and what kinds of insurance you need.

You don’t have time to walk an uninformed agent through the inner workings of your business (over and over again, probably). Work with one that won’t have to ask the basic questions and who can skip to the important matters of your specific situation.

—

Every hour you spend figuring out insurance is time you don’t spend focusing on what makes you money and helps your business thrive. Use a trusted advisor who understands you, get the information and policy you need, and move on to the more important things.

We’d love to help with that.

Insure My Food offers affordable insurance made easy for food trailers, food trucks, and mobile food vendors. We offer a one page quick quote form, or check out our other blogs.

Joel Paprocki, CIC, CRM, CPCU is founder of Insure My Food. Joel has over 20 years of experience in the insurance industry. He is passionate about helping food entrepreneurs navigate insurance and risk management with confidence. He holds all three top industry designations: Certified Insurance Counselor, Certified Risk Manager, and Chartered Property and Casualty Underwriter. He has served over 5,000 clients in the food industry, including restaurants, food truck, cateriers, If you are looking for a reliable, experienced, and specialized insurance partner, please contact us.

Joel Paprocki, CIC, CRM, CPCU is founder of Insure My Food. Joel has over 20 years of experience in the insurance industry. He is passionate about helping food entrepreneurs navigate insurance and risk management with confidence. He holds all three top industry designations: Certified Insurance Counselor, Certified Risk Manager, and Chartered Property and Casualty Underwriter. He has served over 5,000 clients in the food industry, including restaurants, food truck, cateriers, If you are looking for a reliable, experienced, and specialized insurance partner, please contact us.